Why EMS Is the Next Big boom?

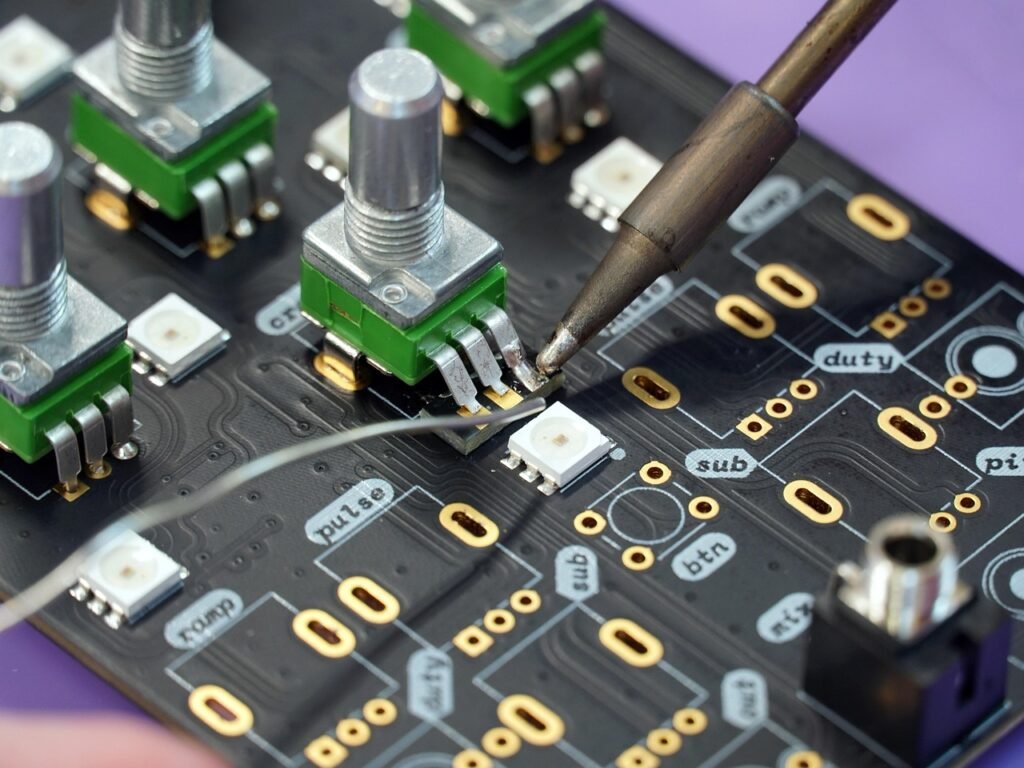

EMS companies offer end-to-end manufacturing services for electronics appliances such as smartphones, smart TVs, washing machines, electric vehicles, and industrial automation. These EMS companies make designing, assembling printed circuit boards (PCBs) and then produce fully finished electronic products also.

The global electronics industry is growing and changing very fast.

During this growing period, India’s EMS (Electronics Manufacturing Services) sector drawn the global manufacturer’s attention.

Here we discuss why this this sector is growing aggressively.

The “China + 1” Shift

In few decades China’s was the electronics manufacturing hub. But now after covid few reasons like trade tension, labour costs and supply chain disruption during COVID time forced global giant companies for diversification outside China. The negative news for China opened a massive door for India and Indian EMS companies to move forward.

Government Push Through PLI Schemes

The Production-Linked Incentive (PLI) schemes provided by Government of India towards local production of mobile phones, consumer electronics, semiconductors, and more are also supporting electronics manufacturing ecosystem. Hence, this reduces India’s import dependence by enhancing domestic EMS firms more globally competitive.

Rising Electronics Demand in India

Due to huge population with high numbers of young people, Indian markets for smartphones, wearables, EVs, and smart appliances are also growing fast. By considering young generations demands on 5G rollout, AI-driven devices, and smart infrastructure booming, domestic electronics demand is also at an all-time high.

With the partnership with both national and international brands, EMS companies are also trying their best to fulfil the demand.

From Assembly to Innovation

The companies like Dixon, Syrma SGS, and Kaynes are surmount the low-margin assembly work aggressively and moving towards to add high value chain into: High-end PCB manufacturing, Design and R&D services, Component-level production, and Semiconductor packaging (OSAT) etc. This step improves their margin, build client relationships, and creates, making them long-term winners.

Global Investors View

According to JPMorgan EMS is the “sunrise sector of India” and the firm has put EMS sector in spotlight.

In their recent reports, they are expecting a 32% compound annual growth rate (CAGR) for Indian EMS companies from FY25 to FY30. This growth is much higher than the most traditional industries.

Stock-by-Stock Breakdown

Dixon Technologies

- Market Cap: ₹ 95,029 Crore (Large cap) and P/E: 123

Rating: Overweight

Outlook: Revenue set to grow ~38 % CAGR during FY25–28, roughly doubling by FY27.

Key drivers: mobile-phone manufacturing growth (Vivo JV + anchor client), with a market opportunity of 90 million outsourced units and potentially further expansion.

Syrma SGS

- Market Cap: ₹ 11,528 Crore (Mid cap) and P/E: 67.3

Rating: Overweight

Outlook: ~31 % sales CAGR till FY28; expected EBITDA margins ~70 bps to ~9 % by then

Growth catalysts: Rising demand in industrial and automotive segments, improving profit share from consumer electronics, and an export recovery cycle

Kaynes Technology

- Market Cap: ₹ 40,970 Crore (Large cap) and P/E: 140

Rating: Overweight

Outlook: 46 % revenue CAGR through FY28, aiming for a $1 billion topline

Profit margins: Projected EBITDA expansion to ~15.7 % by FY28, driven by diversification into industrial, automotive, OSAT, and PCB segments