Market Updates:

Today, Nifty 50 opened at 25,089.50, made its high/low at 25,245.20/ 25,088.45 respectively, and closed with a rise of 113.50 points (0.45%) at 25,195.80 whereas Sensex opened at 82,233.16, made its high/low at 82,743.62/ 82,221.74 respectively, and closed with a rise of 317.45 points (0.39%) at 82,570.91. So, Both Nifty and Sensex has shown Positive performance today. Here we are discussing about a auto ancillary company’s unique business strategy with an organic growth, high volume, with both national and international business expansion with a strong financial. The company is Banco Products Ltd (https://www.bancogaskets.com/about-us/).

About the company

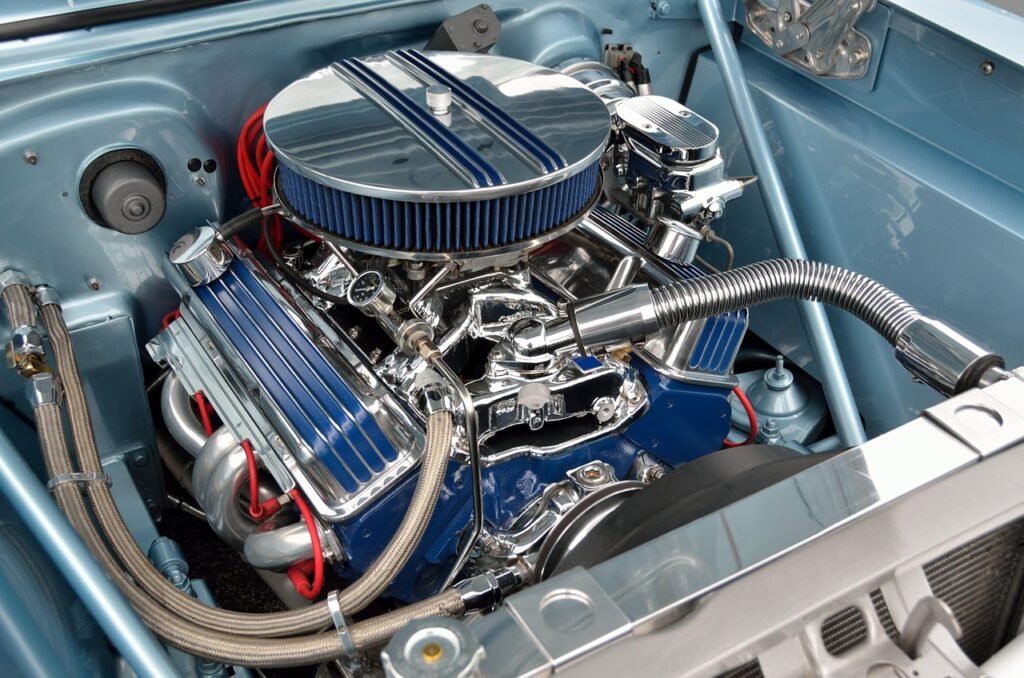

Banco Products Ltd dominates the market on engine cooling systems (like radiators, oil coolers, intercoolers) and sealing gaskets, serving the automotive, industrial, and off-highway sectors. For both traditional and electric vehicles, the products are very essential for thermal management in engines.

The reason behind Banco products is different from others are:

Banco produces in a niche and high demand products. It’s strategic Global presence as well as expansion through acquisitions like NRF B.V. in Europe. It has also strong client base such as Tata Motors, Cummins, Caterpillar, and Ashok Leyland.

The company also focus on operational discipline such as cost control, high margins, and strong return ratios. This focused and scalable business has delivered outstanding returns to shareholders.

In the share market, its every investor dream is to recognize the capacity of the company for creating wealth. For Example, Rakesh Jhunjhunwala’s Titian story, Basant Maheswari’s Page Industries story Ashish Kacholia’s Aditya Vision story and recently Vijay Kedia’s Cera Sanitaryware story. The ultimate truth is you have to hold the company for a certain period of time.

In last five years, Banco Products has quietly turned that dream into reality. In July 17, 2020, the stock was traded at price ₹ 41.65 (this price is the adjusted price after Bonus). Today in July 15 2025, the stock is trading at ₹ 674. The stock has delivered a phenomenal return which is more than 15x.

Here, we are providing an overview about Banco Products financial.

Financial Overview

The market cap of the company is ₹ 9,741 Crore. So, it’s now a small cap company but according to the company’s performance, soon it will be a midcap one. The stock is trading in a current price ₹674. The 52-week high/low are ₹690/293 respectively. Hence, the stock is trading near its 52-week high now. The price earnings ratio of the stock is 24.6. The company has reasonable P/E. The ROE/ROCE are 33.3 /33.4 % respectively. The company’s dividend yield is 1.67%.

Since, it’s a small cap company. It’s better to compare the yearly results between March -2024 and March 2025 Rather than quarterly results:

Revenue was ₹ 2,768 Crore in March-2024 and it is ₹ 3,213 Crore in March-2025. Net profit was ₹ 271 Crore in March-2024 and it is ₹ 392 Crore in March-2025. Accordingly, the EPS was ₹ 18.98 in March-2024 and it is ₹ 27.39 in March-2025.

The company’s short-term and long-term performance:

The company’s short-term and long-term returns are: 1-day return: 1.83%, last 5days return: 3.90%, 1-Month return: 10.56%, 6-months return: 45.88%,1-year return: 94.17%, 3 years return: 646.51%, 5-years return: 1519.21% and its all-time return is 4447.54%.

Banco Products with his strong fundamentals, steady execution, and smart global strategy has created massive wealth quietly. May be short-term gain can define by luck but the long-term return like 15× return in five years wasn’t luck. It’s the company’s consistent performance, result of focused growth, profit expansion, and efficient capital use. The solid financial base and global presence suggest that Banco Products could still be a steady long-term compounder for patient investors.